What to Expect During Post–Term Sheet Due Diligence

So, you’ve got your term sheet? Now it’s time to celebrate, fundraising is finally over. Well not quite, post–term sheet due diligence is one of the most critical phases in the early–stage investment process. At a minimum, investors are seeking to confirm that everything is “as represented” by management. And in some situations, investors are still rounding out the investment case. Either way, it’s critical to finish well.

1. More Data Requests

The first thing to be prepared for post–term sheet is another wave of data requests. While the pre-term sheet data room (see our guide here) will give investors an initial view into the business, the post–term sheet data request list will dive all the way into the nuts and bolts of your operation. You can expect requests on everything from legal documents, employee & customer contracts, vendor agreements, and everything in between. Here are some things you can expect to see on the request list:

Accounting & Financial Deep Dive – Investors will have seen your historical financials and projection model but now it’s time to dive into the more granular expenses.

Expect requests for things like bank statements, credit card expenses, accounts receivable / payable aging schedules and much more. Investors need to understand the ins and outs of the financial operation of the business so they can best position themselves to help.

Also expect questions around your bookkeeping practices including individuals and software tools involved, checks and balances, etc.

Legal & Compliance – Legal diligence is often conducted in parallel with operational and financial reviews. Investors want to ensure that everything is above board from a legal and business standpoint so that there are no surprises down the line.

Expect requests for various types of contracts such as customer agreements, vendor contracts, and employment agreements.

IP Ownership is another hot button for investors. Your ability to verify that intellectual property is fully owned by the company and free from potential disputes is essential. Ideally, you have PIAAs for every current and former employee (or at least those R&D related) and clear work-for-hire agreements with development service you’ve used, for example.

Basic regulatory compliance will be important to validate as well, specifically in highly regulated industries like fintech, healthcare, or energy.

2. Customer Validation

If your new investor hasn’t already spoken directly to your customers, they will want to now. Why do they love your product? What makes it essential to their operations? Why did they choose you over other solutions in the first place?

Investors will seek to engage directly with your largest customers and/or a carefully selected representative sample, as outlined by the investor, to gain deeper insights into your product’s impact, customer satisfaction, and overall market fit.

3. Technical Assessment

Most investors at the Series ~A round will conduct a technical assessment during post-term sheet due diligence. While this won’t be as detailed as an acquirer’s tech audit down the line, it will likely involve an advisor or tech consultant who will “kick the tires” for a read on things like scalability, security, software development practices, and your company’s technical debt. This often means interviewing your tech lead(s), perhaps a high-level code review, and a small batch of additional requests. By the way, this can be a useful exercise. Once the review is complete, investors will often provide management with a summary of the findings. This can be a helpful view of the state of your technical side of the house, especially if you are a non-technical founder.

4. Crystallizing the Market and Competitive Landscape

Most investors will take this time to continue deepening their understanding of the market and competitive landscape. This includes reaffirming your product’s differentiation and your ability to sustain a competitive advantage. Investors might reach out to industry leaders and subject matter experts to gain valuable perspectives that complement their internal research, helping to validate that your business is well suited to thrive in a competitive and evolving landscape.

Closing Thoughts

Post–term sheet due diligence is a test of a startup’s organizational soundness. Most investors try to keep the process smooth and transparent by providing detailed updates and documents to keep track of progress. At the end of this phase, the goal is to move forward with confidence, knowing the partnership has a strong foundation for success. We hope these tips can help you navigate this all–important phase of your fundraising process.

All the Best,

The Vocap team

Appendix

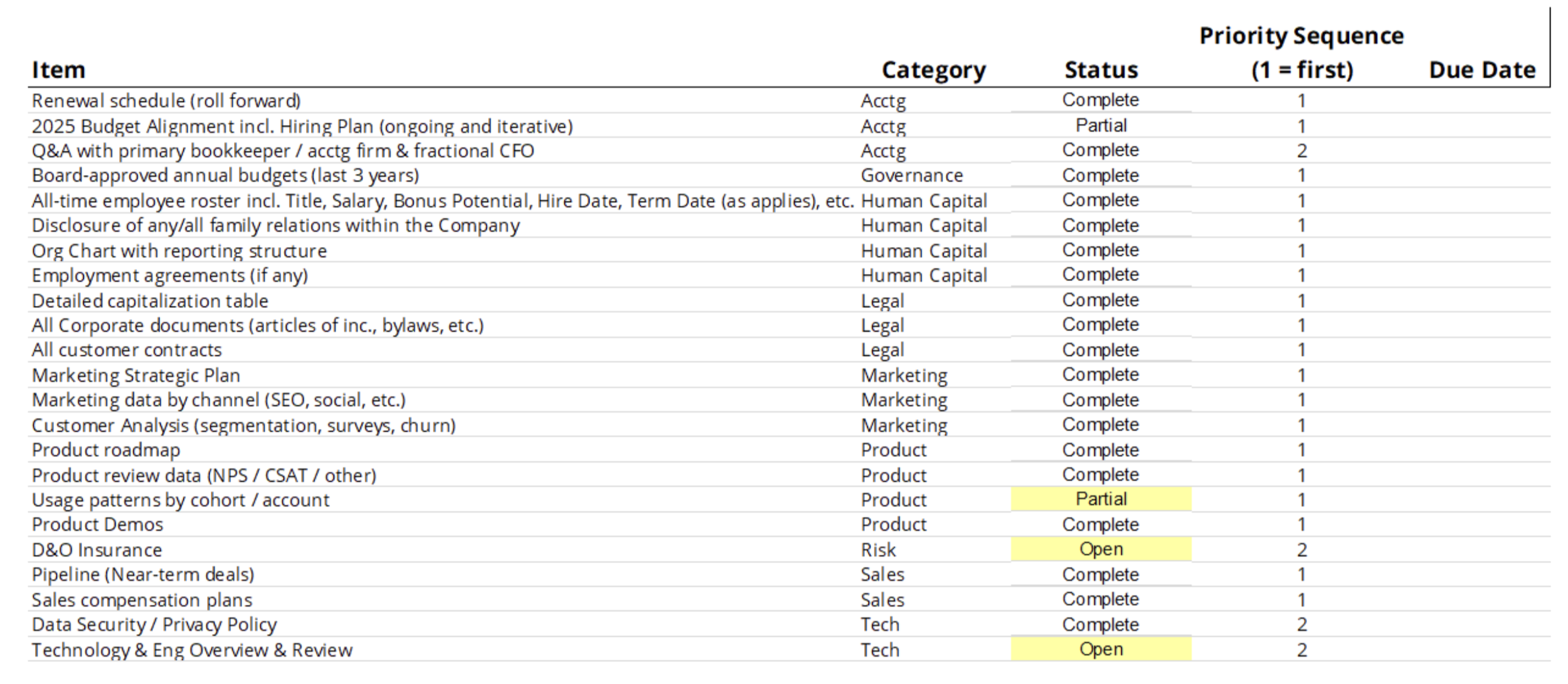

One item you are almost guaranteed to see during this phase of the process is a “diligence tracker” that may look something like the below:

Investors will often send a file like this with requests for various items from these categories. This will guide the process of post-term sheet diligence and keep both parties accountable for reviewing and providing materials.

In a future post, we will aggregate some of the most common roadblocks we’ve seen at this phase. Knowing where others have stumbled might help you avoid the same issues!